2024

The Smart Money Coaching (SMC) program has become a Financial Empowerment Center (FEC). FECs are a national financial counseling model championed by the Cities for Financial Empowerment Fund. The transition provides San Francisco's program with access to infrastructure and a valuable learning community to strengthen services and continue growing. This report reflects on SMC's achievements in its first eight years (2015-2023) and outlines the next chapter of the program’s exciting evolution.

Offered by the San Francisco Office of Financial Empowerment (OFE), Smart Money Coaching is a free, confidential financial counseling service available to anyone who lives, works, or receives services in San Francisco. SMC aims to empower clients to navigate the financial system so that they can make informed decisions and improve their financial lives. Starting from the premise that the financial system is fraught with structural and racist flaws and is not designed to serve low-income consumers,1 financial coaches work with clients one-on-one to identify barriers to mainstream financial services and then outline clear and actionable steps toward resolution.

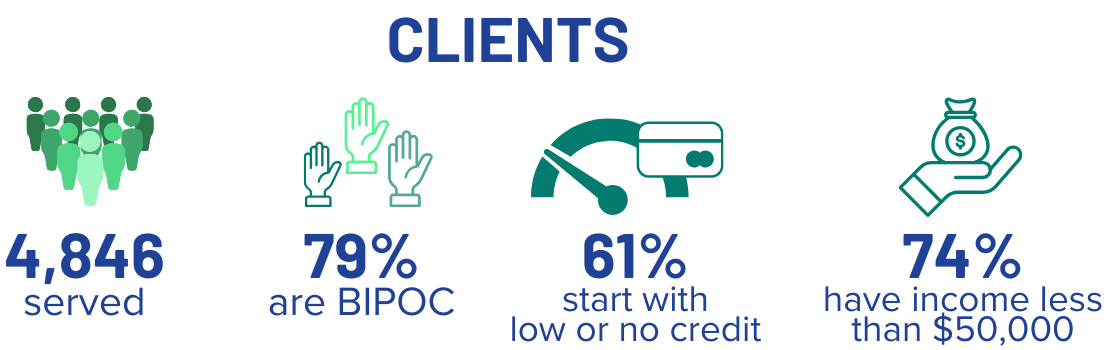

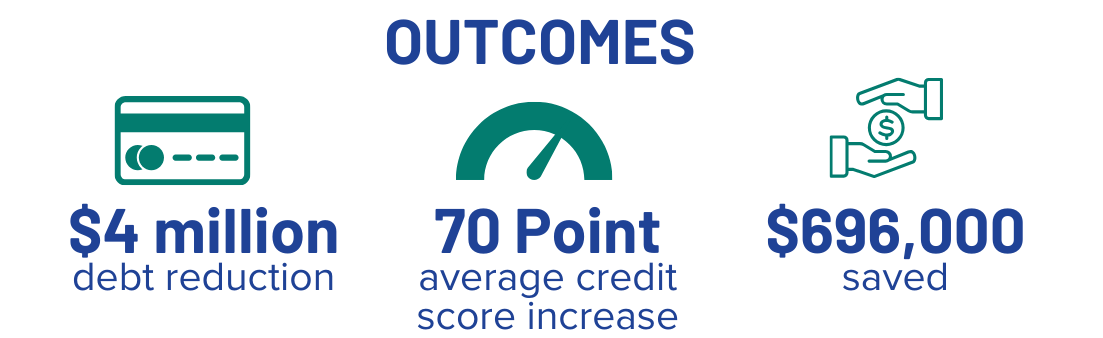

From its launch in 2015 through 2023, SMC supported more than 4,800 clients to open safe and affordable bank accounts, build emergency funds, decrease their debt, and build their credit. SMC financial coaches have helped clients to save more than $696,000 and reduce their debt by more than $4 million. Clients who improved their credit score saw an average increase of 70 points. Most clients served are Black, Indigenous, and People of Color (BIPOC) and have low incomes.

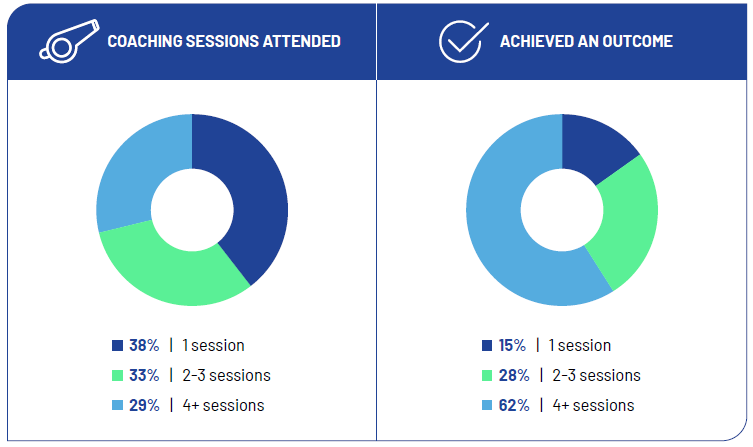

One third of all SMC clients have achieved at least one positive financial outcome, such as improving their credit score or decreasing their debt. Since many financial outcomes take time, outcome achievement is greater among clients who attended more than one session. Indeed, 44% of clients who have attended two or more coaching sessions have achieved an outcome.

Coaching works best as part of a larger fabric of supports and efforts to increase the financial inclusion and wellbeing of individuals and families. SMC partners with programs that provide economic supports such as housing, employment, or guaranteed income, boosting the value of those programs and maximizing the impact of financial coaching as well. In addition, SMC is embedded as a core service in several trusted community organizations. SMC has continually expanded its partnerships and outreach efforts to both spread the word about this free, confidential resource and integrate with other critical services in San Francisco.

While financial coaching is not a silver bullet to address the range of complex financial challenges that many San Franciscans face, it can have a life-altering impact. Working in collaboration with other social supports and drawing on a deep understanding of systemic barriers, financial coaches can help clients identify the best available options for their unique financial circumstances.

Treasurer José Cisneros and his team at the Office of Financial Empowerment created Smart Money Coaching in direct response to community members’ need for credit counseling and hands-on assistance. One family in particular brought these needs to the attention of City officials:

The Ramirez family’s story spurred efforts to address barriers to permanent housing and also highlighted the need to integrate financial counseling into existing city services. Treasurer José Cisneros saw that high quality financial counseling would not only help residents build stronger credit, it would also make the City’s housing and supportive services more effective. Building upon the Treasurer’s prior efforts to support the financial wellbeing of all San Franciscans, like the Working Families Tax Credit and Bank On San Francisco, the Office of Financial Empowerment created the Smart Money Coaching program. SMC provides free, confidential financial coaching to anyone who lives, works, or receives services in San Francisco. This report presents the impacts of SMC’s first eight years (2015 – 2023) and lays the groundwork for the program’s next steps.

Coaching and Counseling

SMC providers are called financial coaches, but they also provide financial counseling.

- FINANCIAL COACHES support clients to build better financial habits and work toward financial goals. Generally, financial coaches support those who are in more stable financial situations and are ready to proactively tackle their financial goals, but they can also work with clients to create financial plans.

- FINANCIAL COUNSELORS support clients who have recently been in financial crisis to rebuild, such as getting out of debt or rebuilding credit. Financial counselors often support those who are falling behind on bills, but they can also help clients learn to budget, save, and make financial plans for their future.

In this report, we refer to providers as coaches, in keeping with SMC’s name and traditions.

SMC is part of a toolkit of other services and resources to address clients’ complex, comprehensive needs. Coaching can complement City and non-profit programs that assist with housing, workforce development, and income supports. From 2015-2023, SMC supported more than 4,800 clients to open safe and affordable bank accounts, build emergency funds, decrease their debt, and build their credit. SMC financial coaches have helped clients to save more than $696,000 and reduce their debt by more than $4 million. Clients who improved their credit score saw an average increase of 70 points.

The Smart Money Coaching Approach

The objectives of Smart Money Coaching are to:

- Help clients navigate financial services options to protect their hard-earned money

- Improve their financial situation to the maximum extent possible

- Set and achieve their longer-term financial goals.

A core belief informing the SMC program is that clients are the best judges of their own financial situations and do not need to be told how to spend their money. Coaching appointments focus on clients’ goals. SMC coaches advocate for clients, walk them through their options, and inform them of their rights as consumers so they feel empowered to make the best decisions.

Clients seek assistance with decreasing debt, establishing or building credit, opening affordable bank accounts, and increasing savings. Coaches help clients achieve these goals by providing the following key services:

- Create or update a budget

- Review and correct errors on their credit reports

- Reduce interest rates on existing debt

- Establish and build their credit

- Open safe and affordable bank accounts

- Save money and build emergency funds

- Set realistic financial goals

- Write housing support letters to advocate for clients working to improve their credit.

In addition to these key services, some coaches take the extra step to provide hands-on assistance, such as going with a client to a financial institution to open a bank account or accompanying a client to the police department to file an incident report for identity theft. This type of direct assistance can be transformative, particularly for young adults early in their financial journeys. For example, one SMC client shared this story:

Read More

Getting Smart about Financial Coaching shares 5 SMC strategies to maximize impact for clients.

![]() The Smart Money Coaching program dovetails with another of OFE’s flagship programs, Bank On San Francisco. This program works with many local banks and credit unions to connect San Franciscans with safe, affordable bank accounts with no overdraft or hidden fees. Bank On San Francisco accounts are vetted to ensure they have:

The Smart Money Coaching program dovetails with another of OFE’s flagship programs, Bank On San Francisco. This program works with many local banks and credit unions to connect San Franciscans with safe, affordable bank accounts with no overdraft or hidden fees. Bank On San Francisco accounts are vetted to ensure they have:

- No minimum balance requirement

- Minimum opening deposit of $25 or less

- Low monthly fees of $10 or less

- Access to online and mobile banking

- Flexible account opening with the acceptance of alternative IDs

- Options for those with negative banking histories

Bank On San Francisco is a valuable resource for SMC coaches as they help clients select safe, affordable bank accounts that meet their individual needs.

Systemic Barriers

Smart Money Coaching recognizes that individuals' financial challenges are often entwined with larger, systemic issues, such as:

- Barriers to accessing safe, affordable bank accounts and credit, including:

- Exclusion from mainstream financial services by banks’ consumer screening services (ChexSystems and Early Warning Systems)3

- Identity theft and high rates of error on credit reports

- Racial and economic discrimination embedded in financial systems

- Predatory lenders and few bank branches in some neighborhoods

- Onerous identification requirements, particularly for immigrants and youth

- Barriers to building credit, especially for those without immigration paperwork

- Lack of permanent address for people experiencing homelessness or housing instability

- Limited bank account options for youth

- Rapidly changing landscape of student loan relief and repayment options

- Economic challenges triggered by the COVID pandemic

- Rapidly changing fintech options and variable regulations making it difficult for consumers to identify safe, reliable financial products.

Smart Money Coaches help clients navigate these challenges and work with clients to set and achieve realistic goals informed by their unique circumstances. For example, an SMC client shared this story:

In addition, SMC is just one of many efforts from the San Francisco Treasurer’s Office to address the financial needs of all San Franciscans. Two sections within the Treasurer’s Office – the Office of Financial Empowerment and the Financial Justice Project – are dedicated to addressing structural barriers in a variety of ways, including advocating for greater consumer protections, working to improve access to affordable financial products, and removing or reducing fines and fees that unduly burden those with low-incomes.

Read More

Systemic Barriers to Banking the Unbanked outlines major structural barriers to banking and identifies opportunities for meaningful change.

Coaching Providers

In 2015, Smart Money Coaching began with a single service provider, BALANCE, and then grew over time to include the SF LGBT Center and Financial Capability Investment.

SMC’s coaching providers have evolved over time, both to address growing demand for services and to address areas of high need. For instance, the SF LGBT Center originally became a coaching provider to address the challenges faced by aging HIV-positive individuals who had financially planned for a short life expectancy but outlived that prognosis due to medical advancements. Financial coaching was a valuable tool for this population who were struggling to readjust their budgets and lifelong spending plans.

Partnerships

SMC works best as part of a toolkit of other services and resources to bolster clients’ comprehensive needs. SMC has developed numerous vibrant partnerships with City departments and nonprofits that have enabled coaching to reach people throughout the city. Importantly, SMC’s partners are critical in bringing coaching to some of San Francisco’s most vulnerable and underserved communities, such as recent immigrants and people experiencing homelessness. Partners engage with SMC in a range of ways, including:

- Spreading the word through flyers and announcements

- Referring clients

- Hosting events and workshops

- Providing funding

- Supplying space for coaching sessions

- Embedding SMC as a core service offering.

SMC works closely with programs that provide economic supports such as housing, employment, or guaranteed income. Pairing financial coaching with these essential resources can maximize the benefits of both programs for clients’ economic wellbeing. Importantly, SMC’s partners often work with clients at pivotal moments in their financial lives, such as starting a new job, undergoing a housing transition, or starting a family. At those transitional moments, financial coaching services – like opening an affordable bank account to receive direct deposits, applying for public benefits, or budgeting to adjust to changing income – can be transformative.

SMC is also embedded in trusted community organizations, including The Women’s Building and the San Francisco Public Library. Beyond co-locating in these spaces, Smart Money Coaching has become a core offering, a trusted referral partner, and part of these distinctive communities.

SMC PARTNERS

City Departments and Initiatives

- City College of San Francisco*

- Department of Homelessness and Supportive Housing

- Department of Parks and Recreation

- HOPE SF*

- Human Services Agency*

- Juvenile Probation Department

- Mayor’s Office of Housing and Community Development

- Rising Up Initiative

- San Francisco International Airport*

- San Francisco Public Library*

Nonprofits

- Arriba Juntos*

- Homeless Prenatal Program*

- Hunters View Bayview YMCA

- Larkin Street Youth Services

- Sunnydale YMCA

- The Women’s Building*

- Young Community Developers*

- United Way Bay Area

* Co-location site: Partner provides spaces where coaches meet clients in person or virtually,

![]() The Rising Up Initiative is a public-private partnership designed to reduce homelessness among young adults (aged 18-24). Rising Up pairs a housing stipend for at-risk youth with wrap-around supports, including financial coaching. Smart Money Coaches assist by reviewing the client’s credit report with them – often the first time these clients have done so – and then supporting the client to remove barriers to housing. This can include removing any errors on the youth’s credit report, reducing debt, and building their credit. Coaches also write housing support letters as needed to help potential landlords understand their clients’ unique circumstances.

The Rising Up Initiative is a public-private partnership designed to reduce homelessness among young adults (aged 18-24). Rising Up pairs a housing stipend for at-risk youth with wrap-around supports, including financial coaching. Smart Money Coaches assist by reviewing the client’s credit report with them – often the first time these clients have done so – and then supporting the client to remove barriers to housing. This can include removing any errors on the youth’s credit report, reducing debt, and building their credit. Coaches also write housing support letters as needed to help potential landlords understand their clients’ unique circumstances.

![]()

Since 1971,The Women’s Building (TWB) has been a trusted neighborhood space offering reliable programming and services. In recent years, SMC has become a core TWB service. A bilingual Smart Money Coach is available on-site once a week to provide both in-person and virtual sessions in English and Spanish. SMC and TWB’s other social service providers regularly refer clients to one another to meet complex needs. SMC and TWB have collaborated to offer programming that is responsive to community needs – like a financial skill building webinar presented in Spanish about the psychology of spending and an in-person workshop on financial empowerment for women.

![]()

Community members count on the San Francisco Public Library (SFPL) to provide free, dependable resources. Over the years, SMC has become one of these core resources. Five to six days a week, a Smart Money Coach is on site at the Main Library—a centralized location near public transit—where many clients seek in-person counseling. SFPL also sponsors a monthly financial skill building webinar series and regularly features SMC in its community events. The SFPL partnership helps make SMC available to anyone living, working, or receiving services in SF.

Referrals

Between 2015-2023, 74 unique sources across San Francisco referred clients to SMC, including nonprofit organizations, city services, employers, schools, and others. One important source of referrals is the San Francisco Human Services Agency (SFHSA), a city office that administers public assistance programs to support people with basic needs like food, health care, and income. Programs supported by the SFHSA, such as their employment, housing, and walk-in services, were responsible for 39% of client referrals to SMC.

In addition to welcoming clients referred by other programs, SMC coaches make referrals to external resources as needed. Referrals can be particularly important when someone is in crisis. In these cases, coaches refer clients to services to meet immediate needs before delving into financial coaching activities.

Over 4,800 Clients and Growing

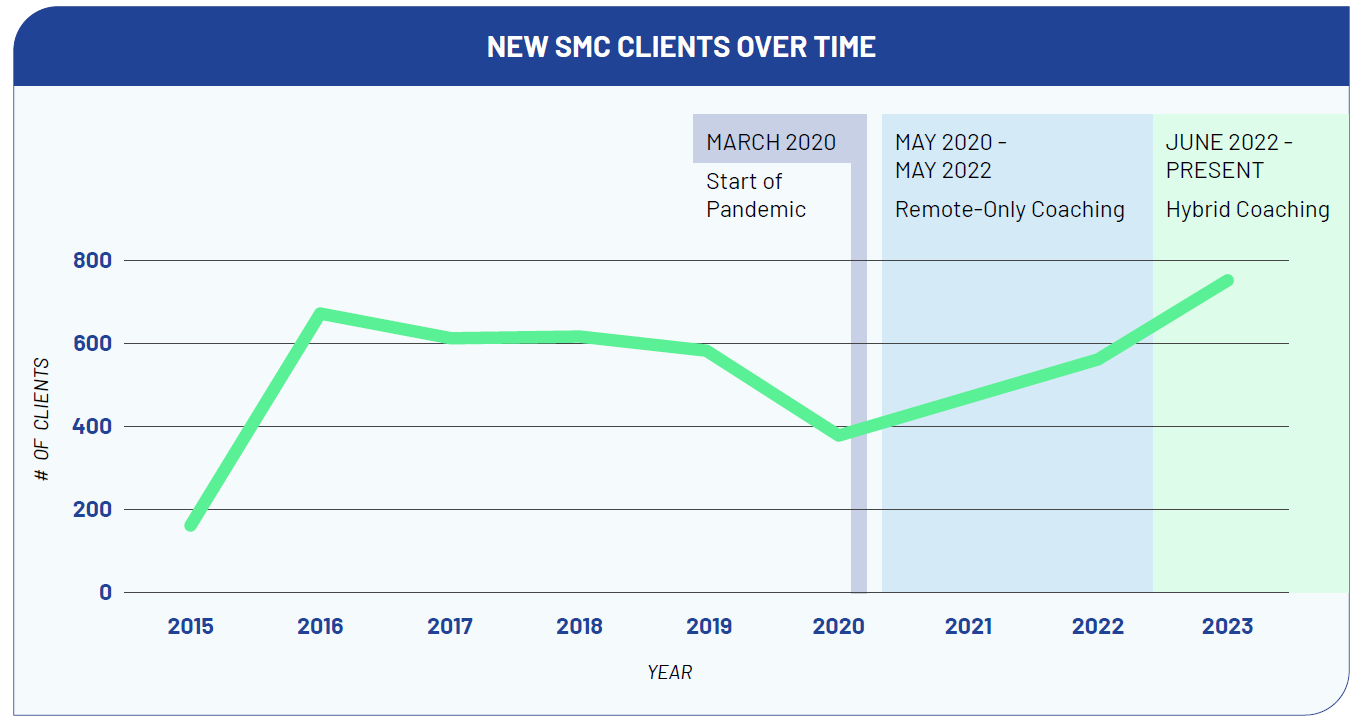

Since launching in 2015, over 4,800 individuals have benefitted from financial coaching through SMC, with more than 17,600 coaching sessions completed.

Starting in its second year of operation, SMC consistently reached more than 600 new clients each year. With the advent of the COVID pandemic in 2020, this number dropped to fewer than 400 but began to rebound in 2021. In 2023, SMC served 754 new clients – a record number.

When the COVID pandemic struck in March of 2020, SMC was able to minimize the disruption in services by introducing first virtual and then hybrid coaching. For two years starting in May 2020, coaching was offered exclusively remotely, by phone or videoconference. Hybrid coaching (where clients can choose in-person or remote appointments) began in June 2022, and the majority of sessions are still held remotely. While many clients like to have face-to-face conversations with their coaches, the convenience of remote meetings – such as not having to arrange childcare or manage the logistics of transportation – is often more important.

Impact Throughout San Francisco

SMC reached clients in almost every neighborhood of San Francisco, with the greatest number of clients coming from Bayview-Hunters Point and the Tenderloin/North of Market/Hayes Valley zip codes. Since SMC is available to people who live, work, or receive services in San Francisco, some clients (21%) live outside the City.

![]()

Reaching Diverse Clients

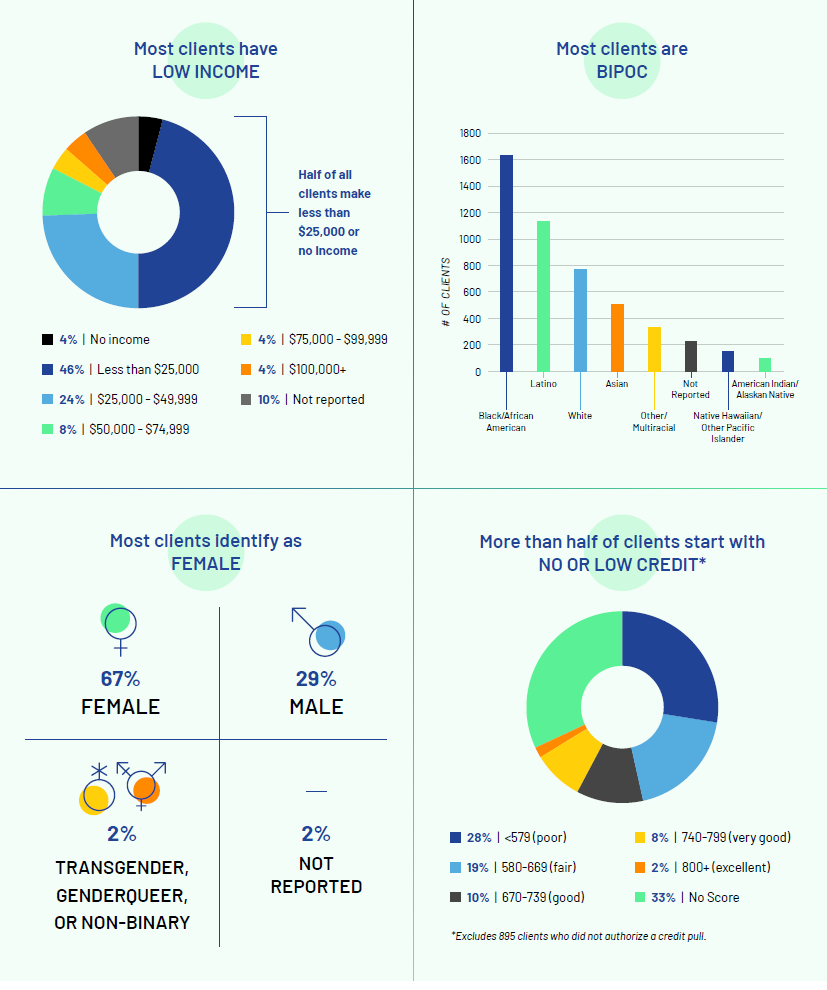

SMC’s clients represent Greater San Francisco’s diverse and vibrant communities. The vast majority of clients have low or moderate household income. 88% of SMC clients have household income less than the San Francisco median income of $136,689.4 Nearly half (46%) of clients have annual income of less than $25,000, and another quarter (24%) of clients have income between $25,000 and $50,000.

SMC clients represent diverse racial and ethnic backgrounds. The majority of clients are BIPOC, with the greatest representation among people identifying as Black/African American (34%) and Latinx (23%). Sixteen percent of clients identified as non-Latinx White, and 10% as Asian American. Two-thirds of SMC clients (67%) identify as women, potentially driven by partnerships with organizations like The Women’s Building and Homeless Prenatal Project.

Many Clients Struggle with Debt and Low or No Credit

SMC clients come to the program with a range of financial experiences and needs. Many seek help managing their debt and building or improving their credit. While debt burdens vary widely, at the median, clients began coaching with $5,300 in debt. A third (33%) of new clients had no credit score, and more than a quarter (28%) had a low score (below 579). Among those who did have a credit score at their first appointment, the median score was 601, which is considered fair. Clients often seek assistance with budgeting and building savings. 22% of new clients had not made a budget, and 24% did not have a bank or credit union account. As detailed below, SMC clients have achieved tremendous progress on managing debt, building credit, and beginning to save.

Measuring Positive Financial Outcomes

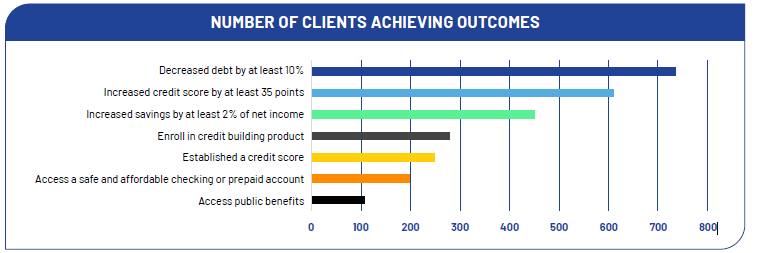

To gauge clients’ success with SMC, the program staff identified a variety of positive financial outcomes – indicators of meaningful change in clients’ economic circumstances. SMC has tracked the following six positive financial outcomes since the program’s launch:

- Access to a safe affordable checking or prepaid account: Open a new account (if unbanked previously) or transition to a safer account (if banked previously)

- Access public benefits, such as unemployment insurance, assistance with health insurance, utilities, or transportation, or other food or income supports

- Enroll in a credit building product

- Establish a credit score (for clients with no previous credit)

- Increase credit score by at least 35 points

- Increase savings by at least 2% of net income

- Decrease non-mortgage debt by at least 10%.

These outcomes are assessed at each coaching session. If a client reports an outcome, the coach seeks to document it using things like a bank account statement, a screenshot of a bank website, or a credit report. Any reported outcomes that cannot be verified are not included in the official outcomes counts.

Most Common Outcomes: Debt Reduction, Improved Credit, and Savings

One-third (33%) of all SMC clients have achieved at least one positive financial outcome. The most common outcome achieved is decreasing debt by at least 10% (736 clients), followed by increasing one’s credit score by at least 35 points (610 clients). The next most frequently achieved outcome is increasing savings by at least 2% of net income (450 clients).

Notably, many clients achieve these outcomes more than once, such as raising their credit score by at least 35 points and then doing so again at a later time. For instance, Maria (a pseudonym) met with a Smart Money Coach four times over a three-year period. About a year after her first coaching session, Maria had reduced her debt by $1,275. Over the next two years, she paid off an additional $6,890 in debt. At each coaching session where Maria showed that she had saved at least 2% of her income, her coach recorded this as an outcome achieved. However, in our findings, Maria would be counted only once, as we are reporting the number of clients who achieved each outcome at least one time. For this reason, we expect the true impact of the program is even greater than what we’ve reported here.

These outcomes can be transformative for clients, and the numbers add up. Among those who achieved these outcomes, SMC clients:

- Reduced their debt by more than $4 million

- Improved their credit by an average of 70 points

- Saved over $696,000.

CLIENT SPOTLIGHT

CLIENT SPOTLIGHT

When she met her Smart Money Coach, Ana (a pseudonym) had been denied housing due to her poor credit and was couch-surfing. She was frantic and desperate to find housing. The Smart Money Coach wrote Ana a Residential Tenancy Letter of Support and cleared two medical collection accounts totaling more than $1,900. On New Year’s Eve, a landlord who had received her application and the letter of support contacted the Smart Money Coach, who advocated for Ana and shared a timeline on addressing her derogatory credit accounts. This conversation was a deciding factor for the landlord to offer the apartment to Ana. Ana and the Smart Money Coach continue to work together to rebuild her credit and help her with her budget to stay current on rent.

More Coaching Sessions Fuel More Outcomes

Because many of SMC’s positive financial outcomes take time, they are likely to take more than one coaching session to achieve. Indeed, 28% of clients who attended two to three sessions achieved an outcome, while the same is true for only 15% of clients who attended only one session. If we look at clients who attended at least four sessions, nearly two-thirds (62%) achieved at least one outcome. The average SMC client attends 3.6 sessions.

Documenting Outcomes and Overcoming Barriers

Because coaches only record outcomes which they’ve verified, the outcomes reported here are likely an underestimate of the program’s true impact. Coaches report that some outcomes are easier to document than others. For instance, because many coaches regularly review clients’ credit reports with their clients, outcomes related to credit scores are simple to document. This is in contrast to outcomes related to savings or bank accounts, which require a screenshot or bank statement to document.

In addition, to achieve some outcomes, such as opening a bank account, clients must overcome systemic barriers, like burdensome ID requirements and account screening tools like ChexSystems or Early Warning Systems, making these outcomes harder and more time consuming to achieve. Compounding these structural barriers, clients who are experiencing a crisis may be more likely to attend only one session, where they’re referred to external resources.

CLIENT SPOTLIGHT

CLIENT SPOTLIGHT

In January of 2023, Alex (a pseudonym) had a FICO credit score of 645. Alex had the advantage of two incomes, which helped them significantly reduce their credit card debt over the course of five months. The Smart Money Coach worked with Alex to "snowball" their credit card payments, focusing resources on paying off the smallest debt first while making minimum payments on all other debts, until the first debt is repaid, freeing up resources to pay off the next debt, and so on. By May 2023, Alex had raised their credit score to 714.

As the economic and financial landscape evolves, SMC strives to support clients and respond to challenges. One challenge for SMC and many coaching programs around the country is coach turnover, which the pandemic exacerbated. To proactively address retention issues, SMC’s latest request for proposals to identify coaching providers included a tiered pricing proposal that would compensate tenured coaches and bilingual coaches at a higher rate.

In addition, SMC has evolved its approach to outcomes in response to coaches’ and clients’ experiences. At times, the activities that had the greatest impact on clients’ financial wellbeing were not captured by SMC’s outcomes. After collecting input from coaches and clients, SMC introduced a slate of nine new outcomes in the summer of 2023, including:

- Use banking account actively

- Adopt a new savings behavior

- Set aside at least one week’s worth of income for the future

- Reduce the number of delinquent accounts on credit report

- Have an incorrect item on a credit or ChexSystems report removed

- Sign up for a student debt relief program (e.g., Public Service Loan Forgiveness, Fresh Start, or income-driven repayment plan such as SAVE plan)

- Have student loan debt forgiven, cancelled, or otherwise removed

- Submit an official incident report (e.g., file a police report in the case of identity theft)

- Escalate consumer rights violation(s) on a credit report to the appropriate attorney.

Collecting data on these outcomes will add depth to our understanding of SMC’s impacts going forward.

From 2015-2023, the Smart Money Coaching program reached nearly 5,000 clients, most of whom are BIPOC and have low incomes. One third of SMC clients achieved at least one positive financial outcome, such as improving their credit score or decreasing their debt. Clients who attended more coaching sessions achieved even more outcomes. SMC has helped clients save nearly $700,000 and reduce their debt by more than $4 million. Clients who increased their credits scores enjoyed an average increase of 70 points.

As the clients’ stories in this report show, financial coaching can have a life-changing impact. Coaching is an important thread in the larger fabric of supports necessary to bolster the success of San Franciscans living with low income.

Transition to Financial Empowerment Center: Even Greater Impact

With the growth of the SMC program, there has been a need to strengthen the program infrastructure as well as a desire to connect with a national learning community. As a result, the Smart Money Coaching program has transitioned to a Financial Empowerment Center(FEC) model, a national financial counseling model championed by the Cities for Financial Empowerment Fund. The transition provides access to infrastructure and a valuable learning community to strengthen services and equip SF OFE’s financial counseling program with the tools to enter the next phase of growth. For instance, for the first time, the program has access to a centralized database for scheduling, data tracking, and analysis to improve efficiency and data accuracy, as well as enable increased data-based decision-making.

The FEC model also requires a greater level of ongoing training, ensuring that financial counselors stay up-to-date with the latest financial trends and tools as well as consumer rights protections. In addition, FECs coordinate monthly learning community calls that bring together financial counselors and program managers nationwide to enable the sharing of best practices, the latest trends and scams to be aware of, and resources. Finally, joining the FEC community provides access to valuable pilots – opportunities to test out the latest financial counseling tools and practices that come with research and evaluation support. OFE is proud of SMC's strong eight-year history and looks forward to tremendous growth and impact for SF's financial counseling program in the coming years.

REFERENCES

- San Francisco Office of Financial Empowerment. Systemic Barriers to Banking the Unbanked. San Francisco Office of the Treasurer & Tax Collector; 2020.

- Lagos M. San Francisco housing dreams haunted by debt. SFGate.

- Oubre M, Cohen M, Lindquist J, Dumez J, Bertolozzi C. Blacklisted: How ChexSystems Contributes to Systemic Financial Exclusion. San Francisco Office of Financial Empowerment; 2021.

- U.S. Census Bureau. U.S. Census Bureau QuickFacts: San Francisco County, California; San Francisco city, California. Published 2024.

AUTHORS

Rebecca Loya & Andrea Yee, San Francisco Office of Financial Empowerment

About the San Francisco Office of Financial Empowerment

The Office of Financial Empowerment (OFE) is a unique private-public partnership housed within the Office of the Treasurer & Tax Collector of San Francisco that convenes, innovates and advocates to strengthen economic security and mobility of all San Franciscans. For more than a decade, under the leadership of Treasurer José Cisneros, the OFE has engaged partners inside and outside City Hall to equip San Franciscans with knowledge, skills and resources to strengthen their financial health and well-being. At the same time, OFE has leveraged what has worked on the ground to model what is possible across the country. To learn more about OFE or the new Financial Empowerment Center, visit: sfofe.org