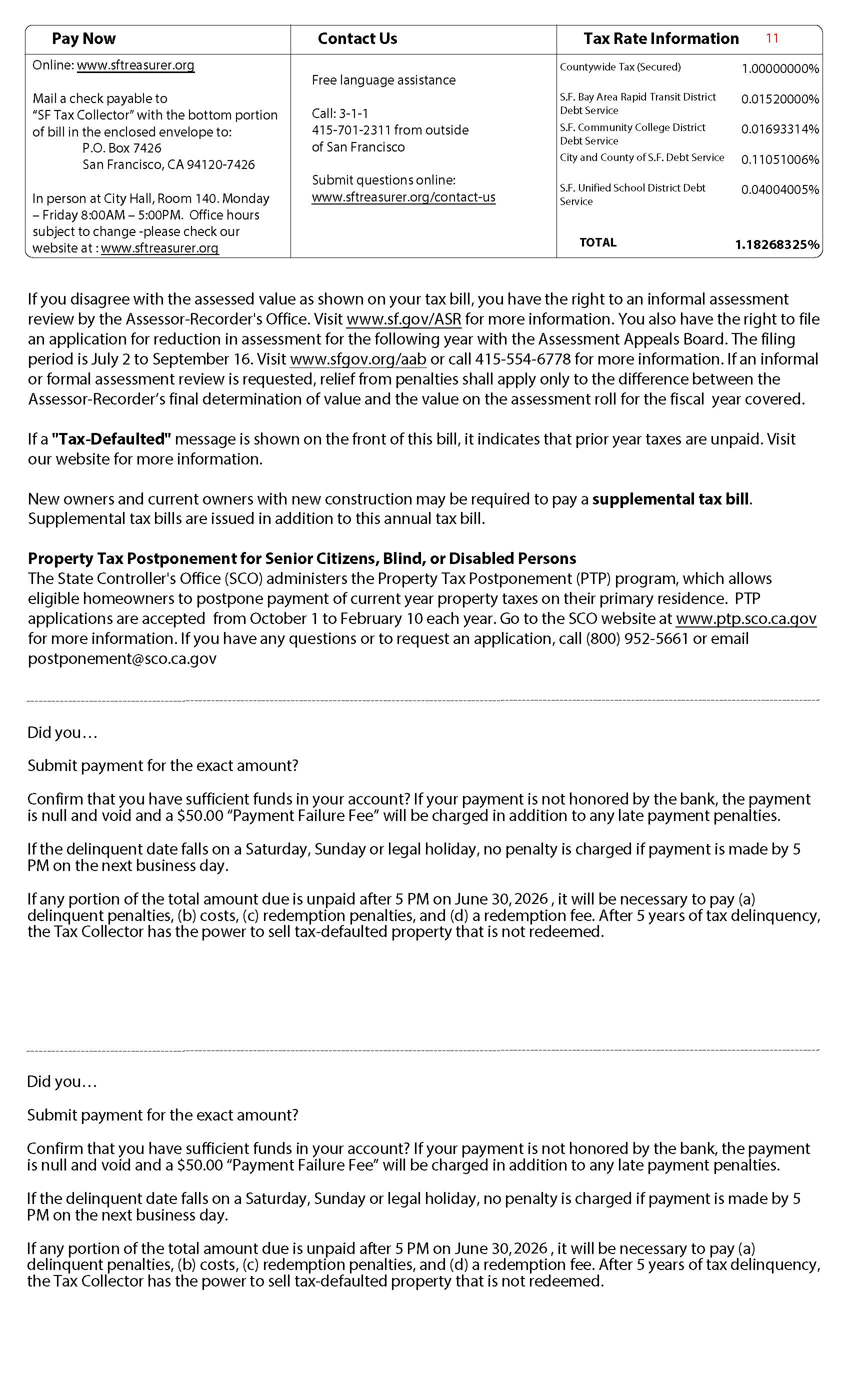

Secured property taxes are calculated based on real property’s assessed value as determined annually by the Office of the Assessor-Recorder. The secured property tax rate for Fiscal Year 2025-26 is 1.18268325%. Secured Property Tax bills are mailed in October. You may either pay the entire tax when the first installment is due, or pay in two installments. Learn how to read your secured property tax bill.

Secured property taxes are calculated based on real property’s assessed value as determined annually by the Office of the Assessor-Recorder. The secured property tax rate for Fiscal Year 2025-26 is 1.18268325%. Secured Property Tax bills are mailed in October. You may either pay the entire tax when the first installment is due, or pay in two installments. Learn how to read your secured property tax bill.

| Delinquent after 5:00pm on: | Penalties |

|---|---|

| December 10th (First Installment) | 10% |

| April 10th (Second Installment) | 10% plus applicable fees |

| June 30th (property becomes tax-defaulted) | Additional 1.5% per month plus redemption fee |

After a change in ownership or when new construction is completed, state law requires the Office of the Assessor-Recorder to reappraise the property. If the property is reassessed at a higher value, a supplemental assessment will be issued calculated on the difference between the new value and the old or prior value. Supplemental bills are often prorated for a portion of the fiscal year based upon the date of sale or date of construction.

Mailed between July 1 and October (mail date printed on bill):

| Delinquent After 5:00 pm on | Penalties |

|---|---|

| December 10 (First Installment) | 10% |

| April 10 (Second Installment) | 10% plus applicable fees |

Mailed between November 1 and June 30 (mail date printed on bill):

| Delinquent After 5:00 pm on | Penalties |

|---|---|

| Last day of the month after printed mailed date | 10% |

| Last day of the 4th month after the first installment delinquent date | 10% plus applicable fees |

After a change in ownership or when new construction is completed, state law requires the Office of the Assessor-Recorder to determine a new base year value for the property. The new value is determined usually by the current market value of the property and subtracting from prior assessed value. However, if the determination of the new value is delayed, an escape assessment is generated. Once the new value is determined, the Office of the Assessor-Recorder will send you notification of the new assessed amount followed by a Secured Escape bill.

Secured Escape assessments for prior fiscal years can be set up on a payment installment plan. An Escape Installment Plan allows taxpayers to make annual installment payments over a four-year period. For more information on Escape Installment Plans, contact the Property Tax division by submitting a 311 service request.

Due dates for current year assessments:

Mailed Date Printed on Bill | 1st Installment Delinquent after 5:00pm on: | Penalties | 2nd Installment Delinquent after 5:00pm on: | Penalties |

|---|---|---|---|---|

October 1 - October 31 | December 10 | 10% | April 10 | 10% plus applicable fees |

November 1 - November 30 | December 31 | 10% | April 10 | 10% plus applicable fees |

December 1 - December 31 | January 31 | 10% | April 10 | 10% plus applicable fees |

January 1 - January 31 | February 28 | 10% | April 10 | 10% plus applicable fees |

February 1 - February 29 | March 31 | 10% | April 10 | 10% plus applicable fees |

March 1 - March 31 | April 30 | 10% | April 30 | 10% plus applicable fees |

April 1 - April 30 | May 31 | 10% | May 31 | 10% plus applicable fees |

May 1 - May 31 | June 30 | 10% | June 30 | 10% plus applicable fees |

Escape Property Tax - Prior Year Assessments:

Mailed Date Printed on Bill | Delinquent After 5:00pm on | Penalties |

|---|---|---|

| Check mailed date printed on bill | Last day of the month following mailed date | 10% plus applicable fees |

Property owners developing affordable rental housing may be eligible for temporary property tax penalty relief during construction of the housing. The relief applies to any installments of ad valorem property taxes due between December 10, 2025, and before April 10, 2031.

Who Qualifies

You may qualify if you meet all the following criteria:

- Filed a welfare exemption application with the San Francisco Assessor;

- Received one of the following:

- A reservation of Low-Income Housing Tax Credits from the California Tax Credit Allocation Committee, OR

- An notice of award of funds from the Department of Housing and Community Development

- Your project is in the course of construction.

Eligibility must be verified annually. Property owners must re-submit this notification and supporting documents each year to continue receiving relief.

How to Apply

- Download and complete and sign the Application of Property Tax Penalty Relief for Affordable Rental Housing.

- Gather the following documents:

- Copy of your exemption application filed with the San Francisco Assessor’s Office

AND - One of the following:

- Letter from California Tax Credit Allocation Committee noting reservation of Low-Income Housing Tax Credits OR

- Notice of award of funds from the Department of Housing and Community Development.

- Copy of your exemption application filed with the San Francisco Assessor’s Office

- Mail the signed certification and required documents to:

SF Tax Collector Relief Notification

P.O. Box 7426

San Francisco, CA 94120-7426 - If approved, you will receive an approval letter at the address listed on the certification and penalties will be waived automatically.

About the Law

AB 2353 added Section 4985.05 to the Revenue and Taxation Code.

AVOID PENALTIES BY UNDERSTANDING POSTMARKS

Tax payments must be received or postmarked by the due date to avoid penalties. If a payment is received after the due date, with no postmark, the payment is considered late and penalties will be imposed.

POSTMARKS are imprints on letters, flats, and parcels that show the name of the United States Postal Service (USPS) office that accepted custody of the mail, along with the state, the zip code, and the date of mailing. The postmark is generally applied, either by machine or by hand, with cancellation bars to indicate that the postage cannot be reused. Foreign postmarks and private metered postage are not acceptable.

Taxpayers who send their payments by mail are cautioned that the USPS only postmarks certain mail depending on the type of postage used, and may not postmark mail on the same day deposited by a taxpayer.

Postage that is postmarked:

STANDARD POSTAGE STAMPS: Stamps purchased and affixed to mail as evidence of the payment of postage.

Postage that is not postmarked:

METERED MAIL: Mail on which postage is printed directly on an envelope or label by a postage machine licensed by the USPS. Many private companies use these types of postage machines.

PRE-CANCELED STAMP: Stamps sold through a private vendor, such as stamps.com®.

AUTOMATED POSTAL CENTER (APC) STAMPS: Stamps, with or without a date, purchased from machines located within a USPS lobby.

PERMIT IMPRINT: Pre-sorted mail used by bill pay services, such as online home banking.

If you use these types of postage, the USPS will not postmark your mail. You will be charged a penalty and fee, if applicable, if we do not receive your mailed payment by the due date.

Other options:

Purchase and complete a CERTIFICATE OF MAILING from the USPS, which is a receipt that provides evidence of the date that your mail was presented to the USPS for mailing. It can only be purchased at the time of mailing through the USPS. The USPS charges a fee for this service.

Purchase a POSTAGE VALIDATED IMPRINT (PVI) Label from a USPS retail counter or window. The PVI is applied to a piece of mail by personnel at the retail counter or window when postage has been paid to mail that item. The item is retained in USPS custody and is not handed back to the customer. The date printed on the PVI label is the date of mailing.

Avoid long lines and wait times at City Hall by paying online or by mail.

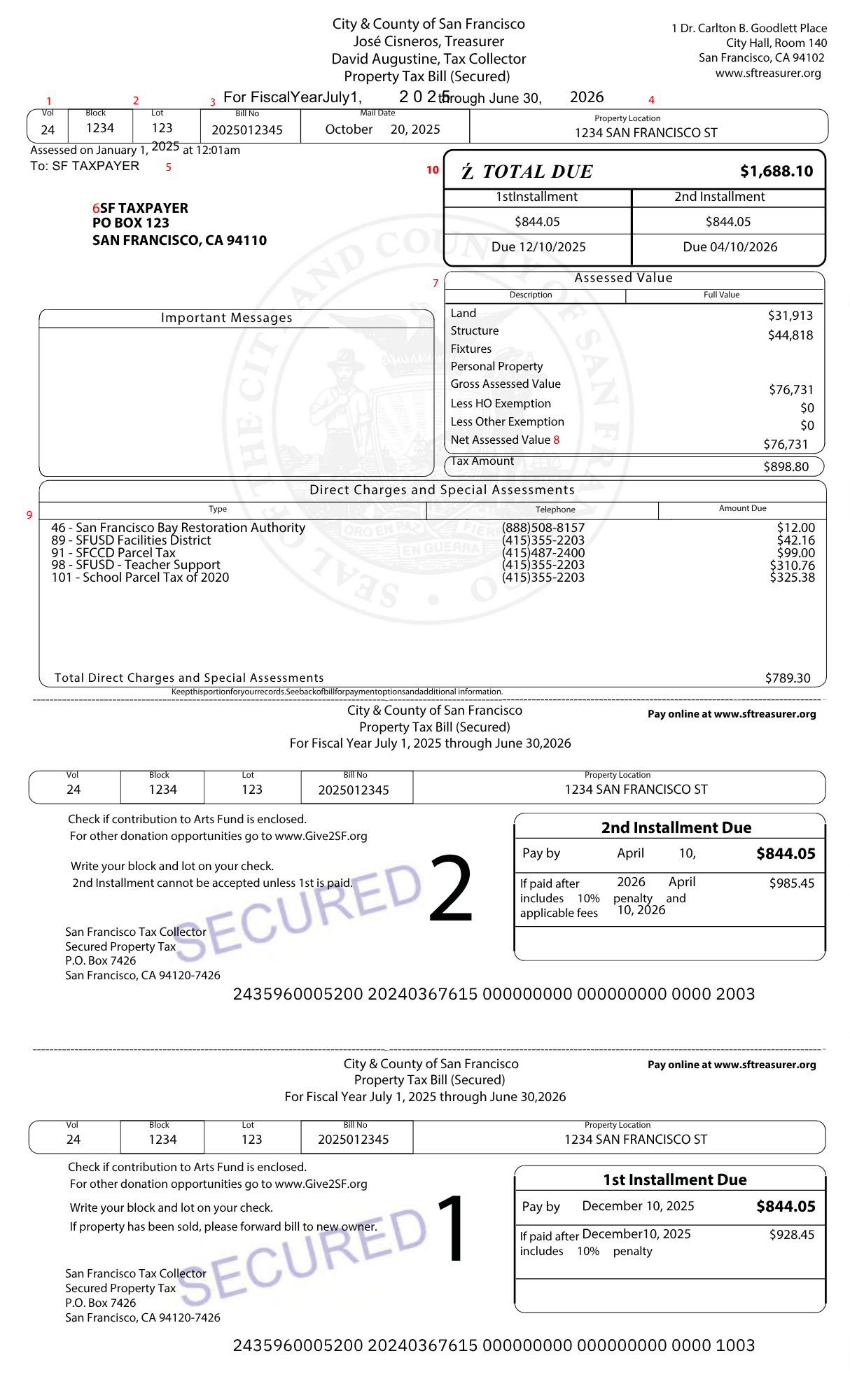

How to Read Your Secured Property Tax Bill

Scroll down for descriptions of the numbered sections

DESCRIPTION OF THE NUMBERED SECTIONS

- Volume

The city is divided into 45 volumes -- your volume number indicates the section where your property is located. - Block and Lot Number

Property is described by Block and Lot numbers according to the city's assessment map. - Tax Bill No

This is an eleven-digit number that uniquely identifies a property's tax bill. - Property Location

Address of the home, building, or vacant lot. - Owner of Record

Property owner as of January 1, each year. - Mailing Address

Contact the Office of the Assessor-Recorder to update your mailing address. - Assessment Information

For more information on how the assessed value is determined, contact the Office of the Assessor-Recorder. - Net Taxable Value

(Gross Taxable Value of your property) - (Exemptions) - Direct Charges and/or Special Assessments

Additional fees or outstanding city debts may be added to your property tax bill by other city departments. Contact the appropriate department, listed on your bill, directly for further information. View list of Special Assessments. - Total Due

(Net Assessed Taxable Value * Tax Rate = Total Tax) + (Total Direct Charges and Special Assessments). The total due is divided into two equal installments. - Tax Rate (back of tax bill)

The annual tax rate is recommended by the Controller, adopted by the Board of Supervisors and approved by the Mayor. The Tax Rate varies slightly from year to year.

Need Further Assistance?

Visit our Help Center to submit a question. Questions submitted before 7:00 pm will receive a response on the SAME DAY. Questions submitted after 7:00 pm will receive a response by the next business day.