Effective January 1, 2024, short-term residential hosts are assessed within the San Francisco Tourism Improvement District (TID). Hosts may pass through this fee to guests. The Board of Supervisors passed legislation that requires Qualified Website Companies to collect the assessment from guests at booking. Additionally, for bookings not made with a Qualified Website Company, the legislation will change the Transient Occupancy Tax and TID filing and payment requirements for hosts to an annual filing requirement, meaning filing and payment of the TID will first be due in 2025.

Tourism Improvement District Assessment

Extension of the TID assessment to hosts is in accordance with the renewal of the TID via an election held in July 2022. The election included short-term residential hosts and hotels to be assessed within the TID. View information about the election.

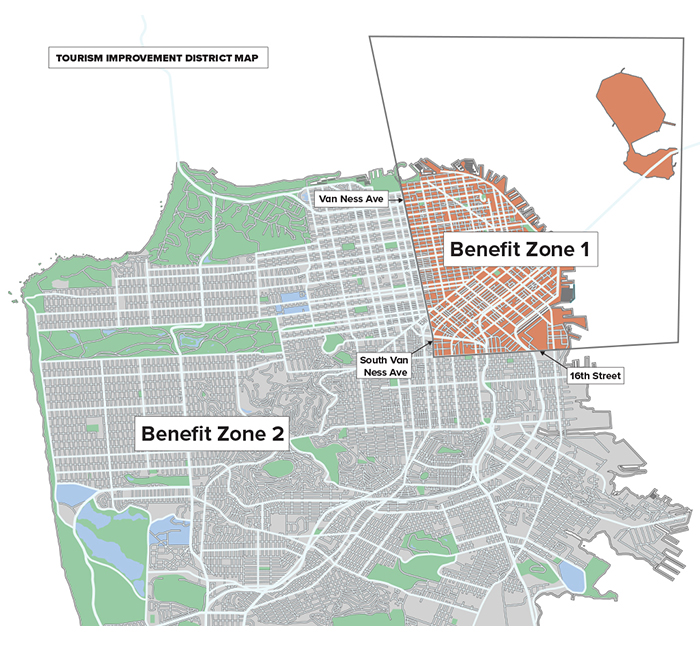

Zone 1 (1.25% assessment rate)

On or east of Van Ness Avenue

On or east of South Van Ness Avenue, and

On or north of 16th Street from South Van Ness to the Bay, including all tourist hotels east of Van Ness Avenue as if it continued north to the Bay, and north of 16th Street as if it continued east to the Bay.

Zone 2 (1.00% assessment rate)

West of Van Ness Avenue and South Van Ness Avenue, and

South of 16thStreet.

Legislative Changes - Annual Filing

The Board of Supervisors passed legislation that requires hosts that do not operate through a Qualified Website Company (QWC) to file and pay the Transient Occupancy Tax (TOT) and TID assessment annually. Summary of the impact:

- Hosts who do business only through a QWC – You will receive a bill for the period of January 1, 2024 to April 30, 2024. If you do not receive a bill, no payment is required. However, if you believe you are required to pay and did not receive a bill, you may login to our payment portal to verify. If the fee is not listed in the payment portal, no payment is necessary. As of May 1, 2024 QWCs are required to include the TID assessment when they file and remit the TOT on your behalf.

- Hosts who currently file annually – No change to your filing timeline. You will be required to pay the TID assessment in your annual filing.

- Hosts will no longer be required to obtain a Certificate of Authority to collect the Transient Occupancy Tax.

Learn More

A webinar was held on January 29 to review the renewal of the TID and the extension of the assessment to hosts. View a recording of the webinar.

For general information about TID, including copies of the Management Plan, please visit www.sftid.com, or contact Paul Frentsos, SF Travel, at (415) 227-2608.

If you need further assistance, you may submit questions electronically at our Help Center, or call 311 (within San Francisco only) or 415-701-2311.