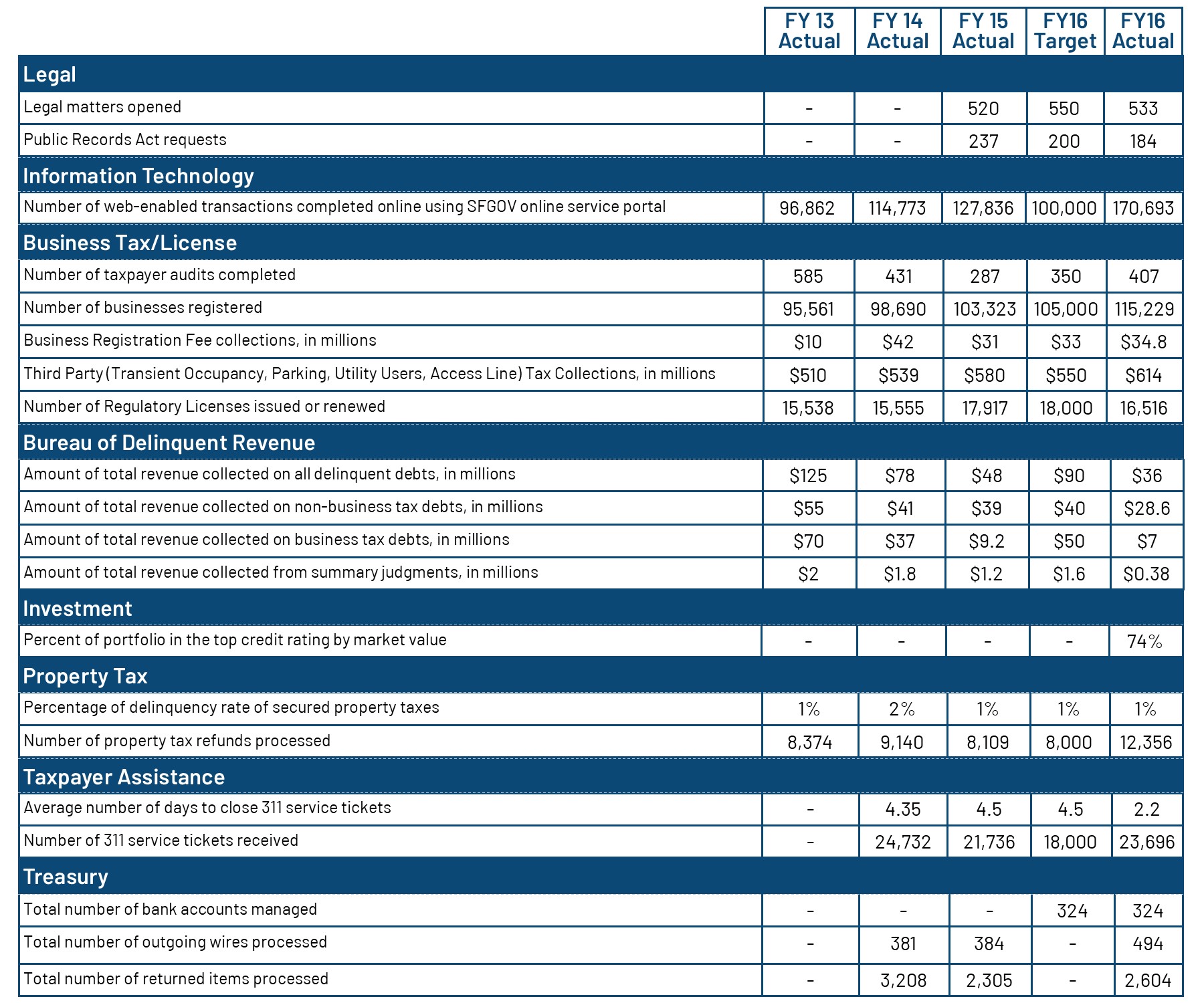

Overview

The position of San Francisco Treasurer is an elective office created by the City Charter in 1850. In July 1979, a charter amendment added the office and duties of Tax Collector to the Treasurer’s responsibilities. The Office of the Treasurer & Tax Collector serves as the banker, collection agent, and investment officer for the government of San Francisco, the only combined city and county in the state of California. The Office of the Treasurer & Tax Collector serves two basic functions for the citizens of the City and County of San Francisco:

- The collection of taxes and other city and county revenue. Through mail, in person in the City Payment Center, and now through the Internet, the Office collects and deposits taxes and other obligations paid to the City, including business taxes, property taxes, and fees for various business licenses and permits that are required by the Municipal Code. Tax Collection units collect over $5 billion annually in property taxes, business taxes, and license fees. Additionally, the Office investigates and collects unreported and delinquent tax obligations. Through the City Payment Center and the SFGov on-line City Services website, the Office contracts to collect current and delinquent obligations owed to other City Departments, such as the Water Department and Department of Public Health.

The conservation and oversight of monies before disbursement. The Treasurer manages all city funds in order to gain the maximum return with low risk and high liquidity, including investing the City’s portfolio of pooled funds. The Treasurer works with all City departments to ensure that funds are received, deposited, and reconciled as quickly and accurately as possible, so as to provide maximum interest and investment returns for the people of San Francisco. The Office administers and monitors the deposit accounts and wire transactions of all City agencies and contracts with banks for financial services. The Office also disburses payments on the City’s General Obligation municipal bonds.

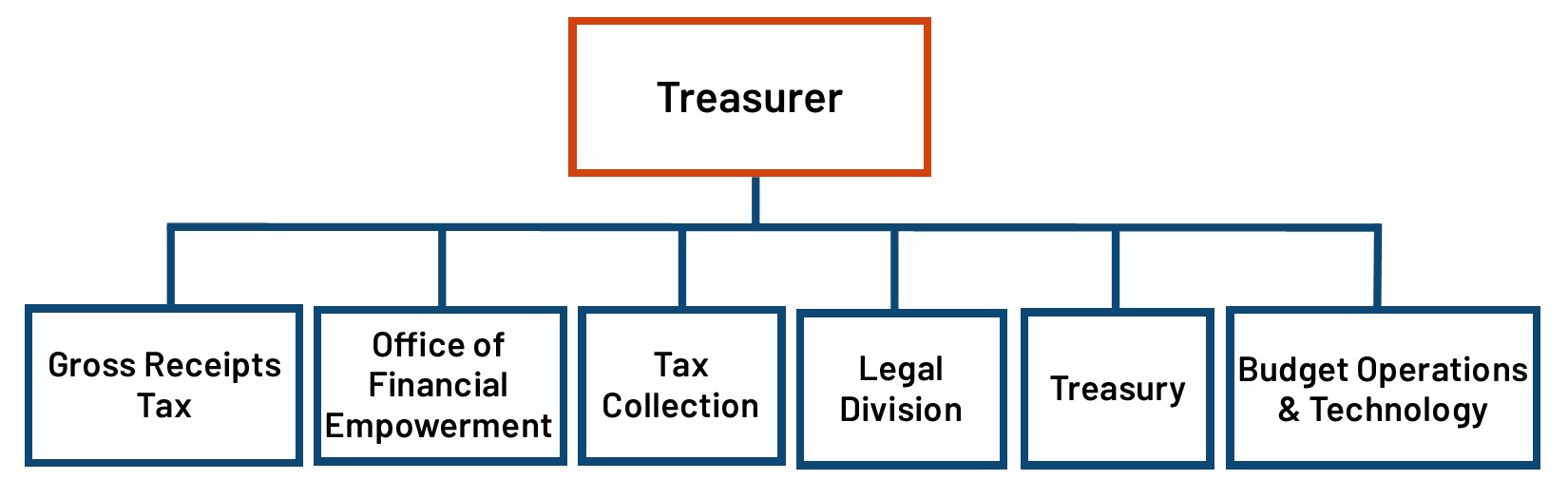

Organizational Chart

Accomplishments

Implementing the Gross Receipts Tax

The Gross Receipts Tax and Business Registration Fees Ordinance (Proposition E) was approved by San Francisco voters on November 6, 2012. The Ordinance changed the business tax base and registration fees for all San Francisco businesses. Two years later, a completely new tax system has been launched. The annual filing was successfully launched on schedule and under budget in January 2015.

Major Technology Improvements

The Department implemented several new technology solutions over the past fiscal year that enhanced the internal workflow for staff and improved overall customer service. Some highlights include Wasau implementation improvements for cashiering, a new Aumentum tax system, a new system for alarm permits and fees, real time secure pin generation, and online parking and Transient Occupancy Tax (TOT) tax filings. The Department continues to build on its successful track record of upgrading or replacing legacy IT systems onto modern off-the-shelf systems to better serve external taxpayers, and create internal efficiencies. Prior year investments in staff and technology have laid a strong foundation for accelerated growth and change.

Kindergarten to College (K2C) Savings

In Fiscal Year (FY) 2010-11, the Department launched the first program in the nation to automatically open a college savings account for all children entering kindergarten in the City’s public schools. The Kindergarten to College program (K2C) includes a matching component and incentives to boost family savings, putting San Francisco at the forefront of national savings policy models. K2C now covers all 4,400 students entering kindergarten in the City each year. Since its inception, K2C has opened 13,000 accounts for San Francisco children. As the only program in North America operating at this scale, K2C is a flagship for ensuring that students have the financial foundation for higher education and financial “knowledge” for good decision-making related to personal finance.

Looking Ahead

Effective Tax Collection

TTX takes seriously its Charter authority and obligation to collect all property and business taxes in San Francisco, and recognizes that the revenue brought in by the Department funds critical programs and services for all San Franciscans. The Department is on an aggressive schedule to implement online business registration to facilitate increased complexity of the voter-approved rate schedules and improve customer service.

Gross Receipts

FY 2015- 16 will bring additional changes to business registration and a major overhaul to the audit division as well as procedures to align more strategically to the new law. The Department will continue outreach to the business community while further simplifying and clarifying filing and payment procedures to facilitate compliance.

Customer Service

The Department will focus on a number of customer service improvements in FY 2015-16. Since the Department’s customer service function was integrated into 311 in FY 2013-14, TTX-related call volume has grown each year, with noticeable spikes around tax deadline periods. The Taxpayer Assistance Unit will continue to work to ensure that 311 is equipped to handle most calls immediately while minimizing the number of calls referred to the Department.

Biographies

José Cisneros, Treasurer

José Cisneros, Treasurer

José Cisneros is the elected Treasurer for the City and County of San Francisco. As Treasurer, he serves as the City’s banker and Chief Investment Officer, managing all tax and revenue collection for San Francisco. Appointed in 2004, and first elected in 2005, Cisneros has used his experience in the tech and banking industries to enhance and modernize taxpayer systems and successfully manage the City’s portfolio through a major recession.

Treasurer Cisneros believes that his role of safeguarding the City’s money extends to all San Francisco residents, and continues to expand his role as a financial educator and advocate for low-income San Franciscans through award-winning programs like Kindergarten to College, Bank On San Francisco and the Financial Justice Project. Cisneros served as Vice Chair on the President’s Advisory Council on Financial Capability for Young Americans, and is currently Co-Chair of the Cities for Financial Empowerment Coalition.

Prior to his role as Treasurer, Treasurer Cisneros served as Deputy General Manager for the San Francisco Municipal Transportation Agency. In this capacity, he managed MUNI’s $7 billion capital program designed to repair, replace and enhance system assets – including the 3rd Street Rail extension serving Chinatown, Mission Bay and the residents of Bay View and Hunters Point. Before working at MUNI, Treasurer Cisneros served as a member of the MTA Board of Directors and was instrumental in creating Proposition E, the Muni Reform Charter Amendment.

Treasurer Cisneros has a strong business background in the private sector, previously working for IBM Corporation and Lotus Development Corporation as a Senior International Product Manager. Prior to this, he was an Assistant Vice President at Bank of Boston where he managed financial product portfolios valued at over $100 million.

Treasurer Cisneros lives with his husband in San Francisco. He received his Bachelor of Science from Sloan School of Management at the Massachusetts Institute of Technology (MIT).

Pauline Marx, Chief Assistant Treasurer

As Chief Assistant Treasurer, Pauline Marx serves as Deputy to José Cisneros and manages investments, banking, cashiering, remittance, and general customer service for the Office of the Treasurer and Tax Collector. Ms. Marx serves as Board President for the City & County of San Francisco Retiree Health Care Trust Fund and is a Board Member of the Government Finance Officers Association. She previously served as President of the California Society of Municipal Finance Officers. Ms. Marx has a bachelor’s degree from the University of Michigan and an MBA from Yale School of Management. She has lived in the San Francisco Bay Area since 1979, working for both investment banking firms and local governmental agencies, always focusing on the intersection of business and public policy at the local government level.

As Chief Assistant Treasurer, Pauline Marx serves as Deputy to José Cisneros and manages investments, banking, cashiering, remittance, and general customer service for the Office of the Treasurer and Tax Collector. Ms. Marx serves as Board President for the City & County of San Francisco Retiree Health Care Trust Fund and is a Board Member of the Government Finance Officers Association. She previously served as President of the California Society of Municipal Finance Officers. Ms. Marx has a bachelor’s degree from the University of Michigan and an MBA from Yale School of Management. She has lived in the San Francisco Bay Area since 1979, working for both investment banking firms and local governmental agencies, always focusing on the intersection of business and public policy at the local government level.

David Augustine, Tax Collector

David Augustine, Tax Collector

In March 2013, Treasurer José Cisneros appointed David Augustine as San Francisco Tax Collector. The San Francisco Tax Collector is responsible for all tax collection in the City and is the ex offico license collector under California law.

Mr. Augustine joined the Office in 2004 as Policy & Legislative Manager, and was instrumental in the implementation of the Treasurer’s many innovative social programs, including Bank on San Francisco, Kindergarten to College, and the Working Families Credit program. As Tax Collector Attorney he represented the office in a number of bankruptcy proceedings and coordinated collections work with the Bureau of Delinquent Revenue.

Prior to joining the City, Mr. Augustine worked in municipal public finance, and with the New York City Mayor’s Office. He holds a J.D. from Stanford Law School and a B.A. in Political Science from Swarthmore College. He is a member of the California State Bar. He has attended the Senior Executives in State and Local Government program at the Kennedy School, and has served on the IRS Advisory Committee on Tax Exempt and Government Entities. Mr. Augustine is a native of the San Francisco Bay Area and resides in San Francisco.

Tajel Shah, Deputy Director

Tajel Shah, Deputy Director

As Deputy Director, Tajel Shah heads finance and budget, solutions management and IT and human resources. Ms. Shah joined the organization in January 2008. Prior to joining the Treasurer & Tax Collector, she managed policy and planning for the Department of Children, Youth and their Families for several years. Ms. Shah comes to the office with a unique blend of public and private sector experience, which includes leading global expansion for Organic Inc. – an internet company and managing several of their Fortune 500 clients. She also served as the first woman of color to lead the national advocacy organization, United States Student Association. Ms. Shah grew up in New Jersey and holds a B.A. from Rutgers University. She lives in San Francisco with her husband and two children and serves on several boards and commissions, including the San Francisco Unified School District’s Quality Teacher and Education Oversight Committee.