Overview

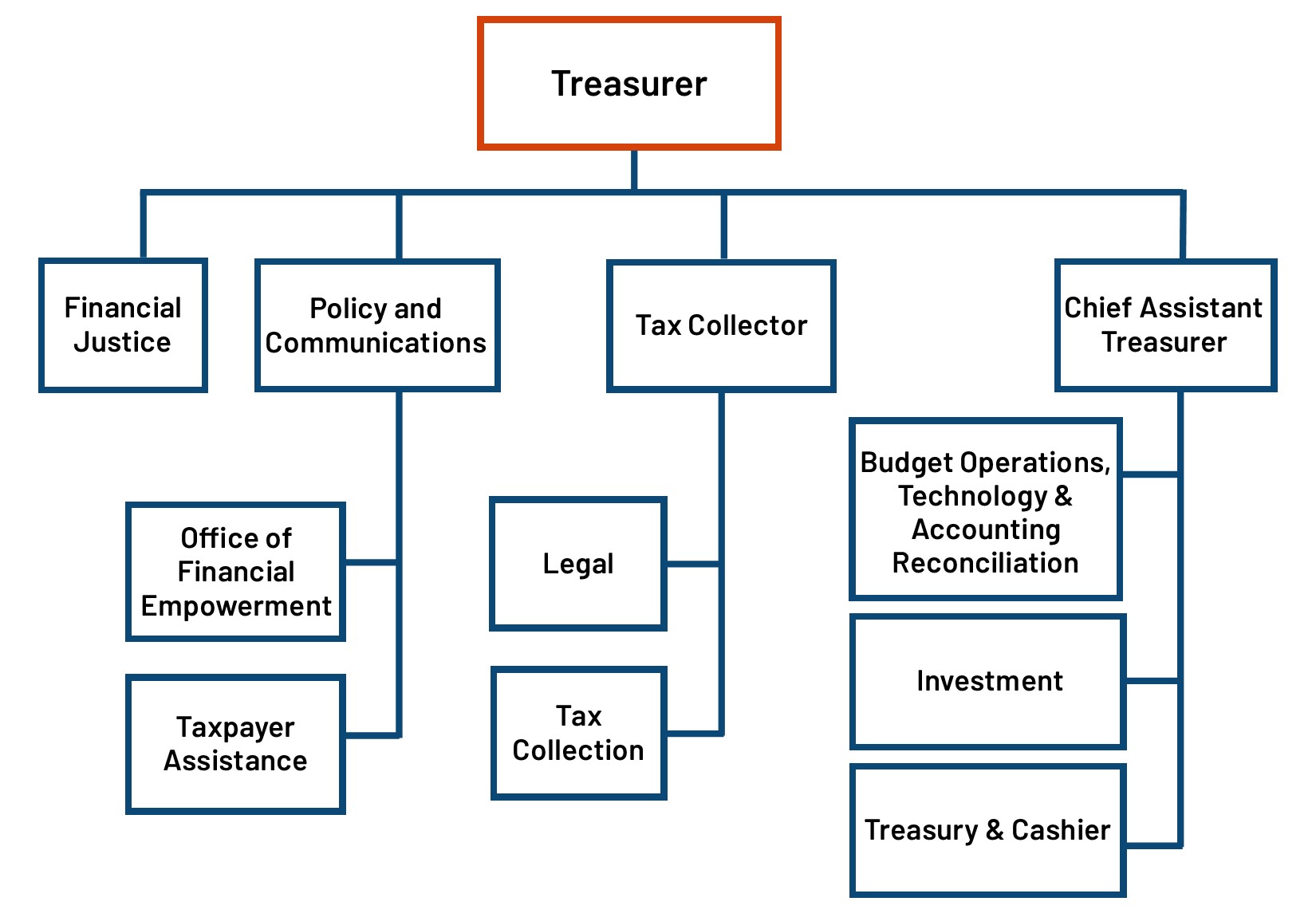

The position of San Francisco Treasurer is an elective office created by the City Charter in 1850. In July 1979, a charter amendment added the office and duties of Tax Collector to the Treasurer’s responsibilities. The Office of the Treasurer & Tax Collector serves as the banker, collection agent, and investment officer for the government of San Francisco, the only combined city and county in the state of California. The Office of the Treasurer & Tax Collector serves two basic functions for the citizens of the City and County of San Francisco:

Mission

The Office of the San Francisco Treasurer & Tax Collector serves as the banker, tax collector, collection agent, and investment officer for the City and County of San Francisco. Our mission is to collect and safeguard the City’s money and use our expertise to assist low-income San Francisco families build economic security and mobility.

Vision

We are committed to providing excellent services for taxpayers, customers, and our community. By promoting diversity, equity, and inclusion, we are a stronger, smarter, and more informed government agency.

Performance Measures

Accomplishments

Tax Implementation and Reform

Filing for the Commercial Vacancy Tax began in 2023 and the Office conducted extensive outreach to property and business owners. This included resources like a new website with an interactive map, instructional videos on filing the tax, and multilingual outreach. The Empty Homes Tax passed in 2022 and will become effective in 2024. The Office is actively working on implementation and determining technology and budget needs.

At the request of the Mayor and Board of Supervisors, the Office is partnering with the Controller to formulate recommendations regarding business tax reform for the 2024 Ballot, with a specific focus on addressing post-pandemic shifts to remote work and encouraging investment in downtown.

Recovery of the local economy and supporting public safety

Property tax revenue is one of the most significant funding sources for public safety programs. Because of comprehensive communication from the Office to property owners, more than 99 percent of secured property tax revenue was collected on time, providing billions in revenue to the City.

The Office is fully committed to an ongoing citywide effort to provide relief to small businesses by implementing the expansion of First Year Free to additional small businesses, with over 3,300 businesses now enrolled and more than $1.1 million in initial license and first-year permit fees waived for qualifying businesses.

Accountability & Equity in Services and Spending

The Office continued its efforts to implement its Racial Equity Action Plan and made significant progress by developing a work plan and training staff. We moved to improve citywide banking services by transitioning the City and County of San Francisco’s primary banking partner to JP Morgan. This partnership includes a first-ever Social Responsibility MOU.

Kindergarten to College (K2C) is preparing to celebrate the first cohort of students graduating from high school in 2023 and readying their college savings for disbursements. K2C continues to build on an equity incentive pilot for low-income families, encouraging college savings by increasing their initial seed money.

The Financial Justice Project (FJP) announced successful outcomes of the “Be The Jury” pilot program, which compensates low-to-moderate-income jurors $100 a day for jury duty service. Their report shows that the program is successful in expanding racial and economic diversity in San Francisco jury pools. FJP also helped to eliminate $300 civil assessment statewide, a hidden fee charged to people in court cases.

Looking Ahead

- Convened three listening sessions to learn about consumer, small business, and government banking needs. Community input will inform plans of the city's contracted banks.

- Complete implementation of business tax simplification and reform measures.

- Celebrate the 20th anniversary of the Office of the Financial Empowerment.

- Continue using AI to accelerate work processes.

Biographies

José Cisneros, Treasurer

José Cisneros, Treasurer

José Cisneros is the elected Treasurer for the City and County of San Francisco. As Treasurer, he serves as the City’s banker and Chief Investment Officer, managing all tax and revenue collection for San Francisco. Appointed in 2004, and first elected in 2005, Cisneros has used his experience in the tech and banking industries to enhance and modernize taxpayer systems and successfully manage the City’s portfolio through a major recession.

Treasurer Cisneros believes that his role of safeguarding the City’s money extends to all San Francisco residents, and continues to expand his role as a financial educator and advocate for low-income San Franciscans through award-winning programs like Kindergarten to College, Bank On San Francisco and the Financial Justice Project. Cisneros served as Vice Chair on the President’s Advisory Council on Financial Capability for Young Americans, and is currently Co-Chair of the Cities for Financial Empowerment Coalition.

Prior to his role as Treasurer, Treasurer Cisneros served as Deputy General Manager for the San Francisco Municipal Transportation Agency. In this capacity, he managed MUNI’s $7 billion capital program designed to repair, replace and enhance system assets – including the 3rd Street Rail extension serving Chinatown, Mission Bay and the residents of Bay View and Hunters Point. Before working at MUNI, Treasurer Cisneros served as a member of the MTA Board of Directors and was instrumental in creating Proposition E, the Muni Reform Charter Amendment.

Treasurer Cisneros has a strong business background in the private sector, previously working for IBM Corporation and Lotus Development Corporation as a Senior International Product Manager. Prior to this, he was an Assistant Vice President at Bank of Boston where he managed financial product portfolios valued at over $100 million.

Treasurer Cisneros lives with his husband in San Francisco. He received his Bachelor of Science from Sloan School of Management at the Massachusetts Institute of Technology (MIT).

Tajel Shah, Chief Assistant Treasurer

Tajel Shah, Chief Assistant Treasurer

As Chief Assistant Treasurer, Tajel Shah serves as Deputy to José Cisneros and manages investments, banking, cashiering, budget, solutions management, IT and human resources for the Office of the Treasurer & Tax Collector.

Ms. Shah joined the organization in January 2008. Prior to joining the Treasurer & Tax Collector, she managed policy and planning for the Department of Children, Youth and their Families for several years. Ms. Shah comes to the office with a unique blend of public and private sector experience, which includes leading global expansion for Organic Inc. – an internet company and managing several of their Fortune 500 clients. She also served as the first woman of color to lead the national advocacy organization, United States Student Association.

Ms. Shah grew up in New Jersey and holds a B.A. from Rutgers University. She lives in San Francisco with her husband and two children and serves on several boards and commissions, including the San Francisco Unified School District’s Quality Teacher and Education Oversight Committee.

David Augustine, Tax Collector

David Augustine, Tax Collector

In March 2013, Treasurer José Cisneros appointed David Augustine as San Francisco Tax Collector. The San Francisco Tax Collector is responsible for all tax collection in the City and is the ex offico license collector under California law.

Mr. Augustine joined the Office in 2004 as Policy & Legislative Manager, and was instrumental in the implementation of the Treasurer’s many innovative social programs, including Bank on San Francisco, Kindergarten to College, and the Working Families Credit program. As Tax Collector Attorney he represented the office in a number of bankruptcy proceedings and coordinated collections work with the Bureau of Delinquent Revenue.

Prior to joining the City, Mr. Augustine worked in municipal public finance, and with the New York City Mayor’s Office. He holds a J.D. from Stanford Law School and a B.A. in Political Science from Swarthmore College. He is a member of the California State Bar. He has attended the Senior Executives in State and Local Government program at the Kennedy School, and has served on the IRS Advisory Committee on Tax Exempt and Government Entities. Mr. Augustine is a native of the San Francisco Bay Area and resides in San Francisco.

Amanda Fried, Chief of Policy and Communications

Ms. Fried oversees taxpayer assistance, communications, legislation and financial empowerment initiatives for the Office of the Treasurer & Tax Collector.

Ms. Fried oversees taxpayer assistance, communications, legislation and financial empowerment initiatives for the Office of the Treasurer & Tax Collector.

Ms. Fried joined the organization in October 2014. Prior to joining the Office of the Treasurer & Tax Collector, she served as Deputy Director in the Mayor’s Office of Housing, Opportunities, Partnerships and Engagement (HOPE) for Mayor Ed Lee, as a Senior Advisor to the Mayor in New York City, and as a legislative aide.

Ms. Fried grew up in Philadelphia and earned a B.A. in Political Science and Urban Studies from Stanford University, and an Masters in Public Administration from the New York University Wagner School of Public Service. She lives in San Francisco with her family.